Tax Credits…in Advance?

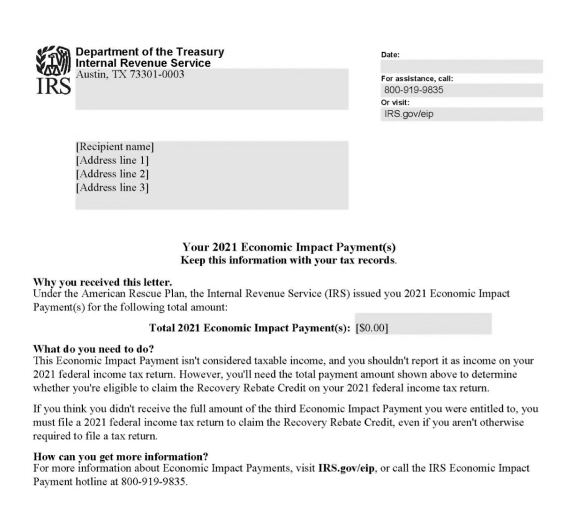

Did the IRS send you money last year? If so, you probably received a letter or two from them recently. The IRS sent out one letter for the amount of Economic Impact Payment they sent you (EIP, aka Recovery Rebate, aka stimulus, aka stimmy check). This is what that letter looks like:

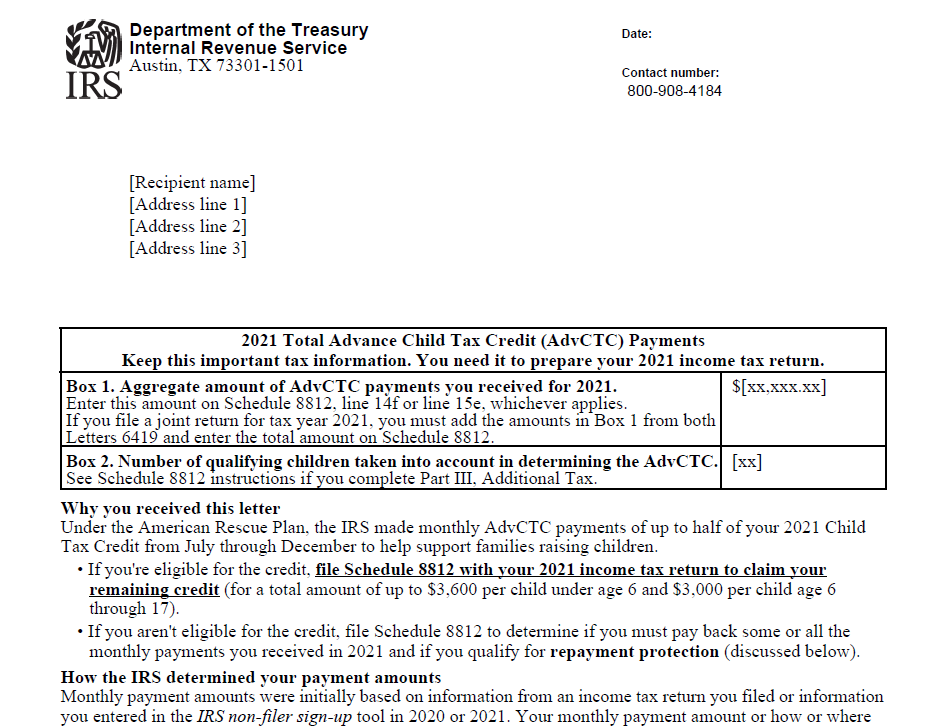

They sent out another letter for the total amount of Advanced Child Tax Credit (ACTC) they sent you. This is what that letter looks like:

If that was all there was to it, it would be pretty simple to figure out. But wait…there’s more! The IRS sent out these letters not just for you, but for your spouse as well. This means that if you received a total deposit of $2,800 for the EIP in 2021, you should receive a letter for your portion, $1,400, and one for your spouse’s, another $1,400. The same holds true for the ACTC.

In summary, we will need copies of every letter you receive from the IRS, or at least the total of all monies you received for the EIP and ACTC in 2021. Failing to report the full amount of these credits could slow down the processing of your tax return while reducing your refund or even costing you money in the end.

We will help you sort it all out.

-Heritage Accounting and Tax Services

<><